$0.49 -0.01 ( -2.89% ) 785.3K

NASDAQ: BIVI

Company Overview

BioVie is a clinical-stage company developing what it believes will be transformative therapies to overcome unmet medical needs in neurodegeneration and liver disease. The Company is developing NE3107 for Alzheimer’s (AD) and Parkinson’s (PD) and BIV201 for refractory ascites and HRS-AKI.

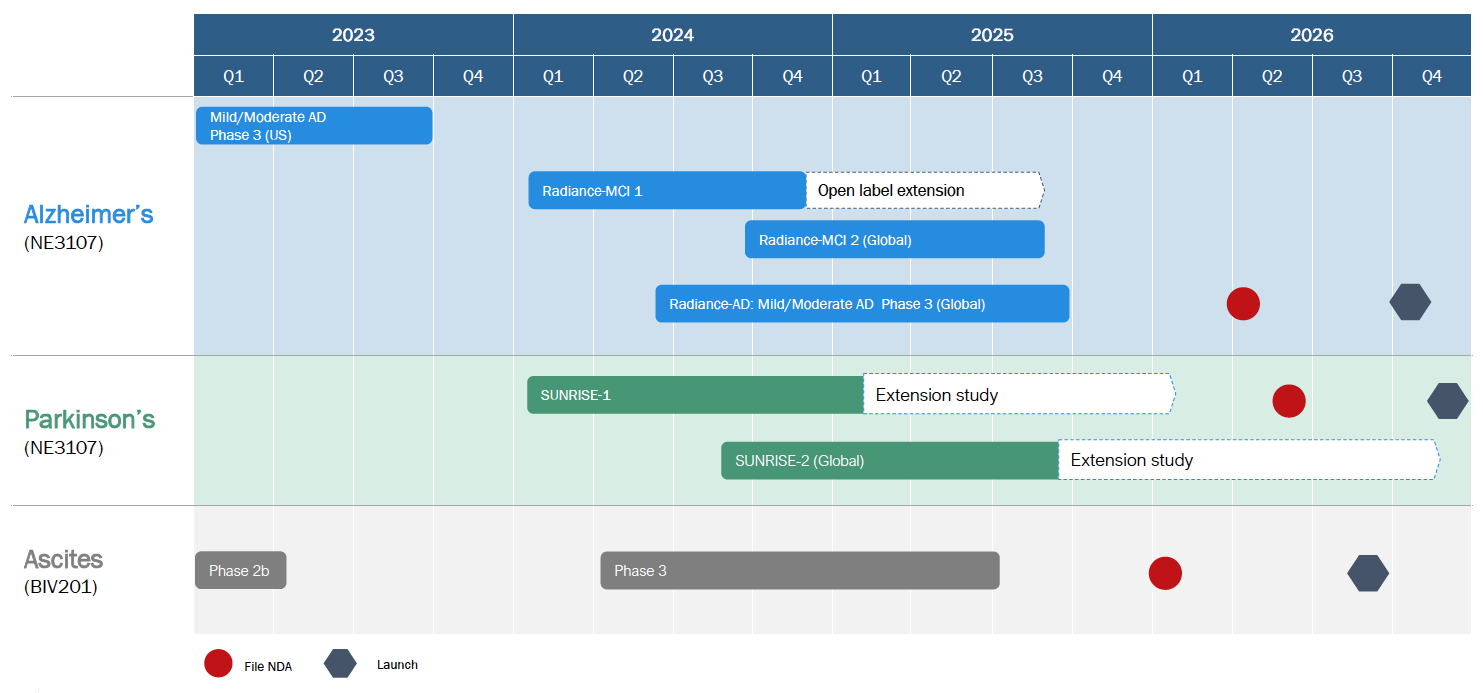

Expected Catalysts and Anticipated Timelines

Value Proposition

BioVie is poised for significant catalysts in 2023, including data read out from its Alzheimer’s Phase 3 trial, expected in Q4 2023, as well as interim data read outs from the Company’s planned Phase 3 study in Parkinson’s. BioVie has multiple other efforts underway that may create additional catalysts and will be announced publicly when the Company deems appropriate.

Commercial Potential in US Market

Market Data

Investment Highlights

-

NE3107 is the only inhibitor of neuroinflammation and insulin resistance in Phase 3 clinical trials for Alzheimer’s Disease (AD)

- NE3107 reduced inflammation and insulin resistance in a randomized, double-blinded, placebo-controlled Phase 2 study. Potential to address the two factors described as key drivers of cognitive decline in AD.

- Phase 3 patient enrollment across 39 sites was completed in Q1 2023 and patient treatment completed in Q3 2023; data readout anticipated in Q4 2023.

- $30+ billion annual peak sales potential.

-

NE3107 also being developed for Parkinson’s Disease (PD) since neuroinflammation, insulin resistance, and oxidative stress are common features in AD and PD. Remarkable parallels exist between AD and PD with respect to underlying disease pathology

- Positive Phase 2 data reported in Q4 2022 demonstrating improved motor control

- Patients treated with NE3107 and levodopa saw a 3+ point advantage in motor control compared to those treated with levodopa alone; NE3107 patients younger than 70 years older saw twice that level of advantage

- 88.9% of patients <70 years old treated with NE3107 and levodopa experienced greater than 30% part 3 score improvements from baseline

- $3+ billion annual peak sales potential.

- Positive Phase 2 data reported in Q4 2022 demonstrating improved motor control

-

Among competitive molecules exploring neuroinflammation and AD, NE3107 is the only one that:

- Has published randomized, double-blinded, placebo Phase 2 results potentially suggesting reduction in inflammation and insulin resistance in a major population and warranting further review in Phase 3.

- Potentially inhibits both overarching mechanisms of AD pathology – inflammation and insulin resistance.

- Potentially inhibits proinflammatory pathways without impacting homeostasis.

- Completed Phase 3 enrollment and treatment and is expected to have topline results in Q4 2023.

-

BIV201 is the only drug currently in development for refractory ascites, a condition with 50% mortality rate. It has the potential to become first therapy since there are no approved drugs in the US

- BIV201 is a novel formulation of terlipressin for continuous infusion; Orphan and Fast Track designations received.

- Data from Europe/Asia supports development of BIV201; no drug-related SAEs in trials thus far.

- Initiating discussions with FDA for pivotal registration trial following encouraging data from Phase 2b study

- $1.6 billion global peak sales potential.

Archived Webinar

RedChip Investor Group Call with BioVie Inc. (NASDAQ: BIVI)

Wednesday, April 10, 2024